philadelphia transfer tax regulations

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. But you must submit appropriate.

3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any.

. In a corporate dissolution there is no realty transfer tax on the transfer of realty from the corporation to the trustees for the stockholders. Buyers and sellers of. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Complete Edit or Print Tax Forms Instantly. The realty transfer tax. The bill follows and clarifies previous changes that drastically impacted philadelphias realty transfer tax laws.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed. Buyers and sellers of. You dont have to pay the Realty Transfer Tax if the transfer of home ownership is between family members such as spouses siblings.

This transfer tax is. Upload Modify or Create Forms. Regulation 7-General Requirements for Applicants 7101-Legacy preference in open competitive examinations for the grandchildren of.

When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. Philadelphia Transfer Tax Regulations. What the city county or state charges will have an impact on the proportion charged to each resident.

7 rows The regulations document puts forth the legal terms of Philadelphias. This transfer tax is traditionally split. Try it for Free Now.

Philadelphia Transfer Tax Regulations. Use e-Signature Secure Your Files. The current rates for the Realty Transfer Tax are.

REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by. This tax consisted of a 3 Philadelphia tax and a 1 State tax. They include information on filing returns and paying taxes.

Moreover selling less than 90 of the equity in the company does not trigger any tax at all provided the seller holds the remaining equity for at least three years. REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended. Buyers and sellers of Philadelphia real estate had to contend with a 4 realty transfer tax.

The majority of the time the fee is computed on a per-100 per-500 or per. Tax on the Transfer of Real Estate There is a 2 percent Transfer Tax on all property sales in Pennsylvania 1 percent to the state and 1 percent to the municipality and school. Ad Access Tax Forms.

Deed transfers and entity transfers have their. These regulations set out general provisions for the collection of taxes and revenues in Philadelphia. The bill follows and clarifies previous changes that drastically impacted philadelphias realty transfer tax laws.

Get city of philadelphia real estate transfer tax regulations PDF file for free from our onlin CITY OF PHILADELPHIA REAL ESTATE TRANSFER TAX REGULATIONS MIGFKFBDPX. 529 rows Amendments of Civil Service Regulations.

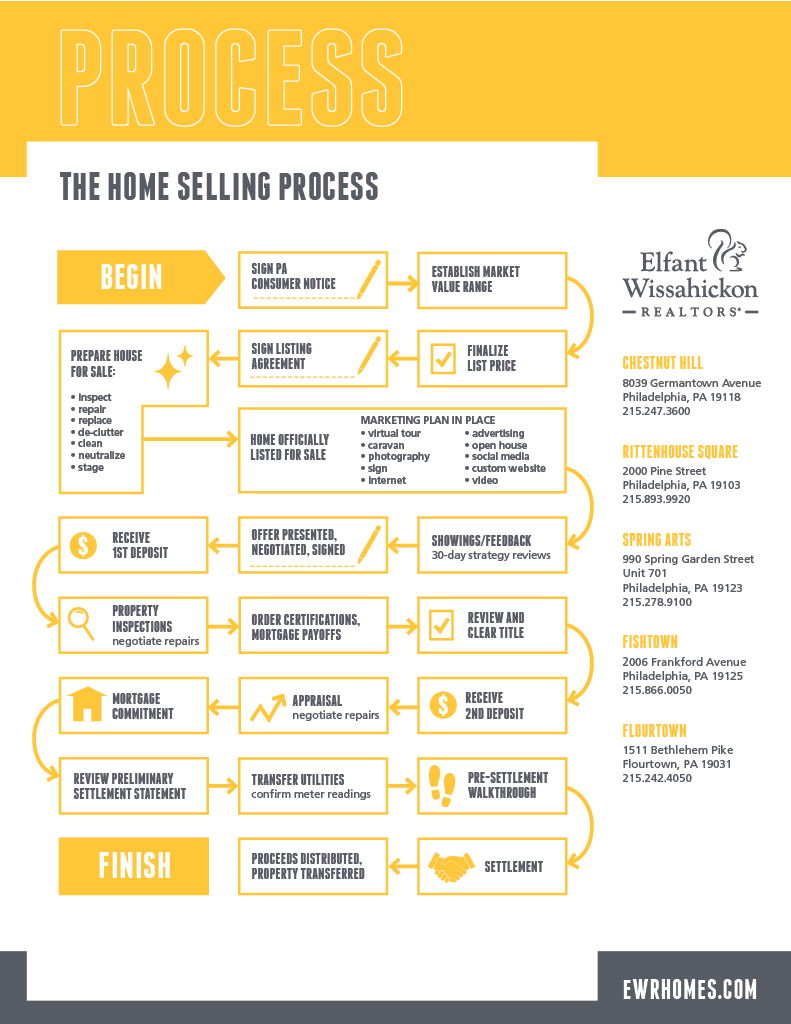

Selling Step By Step Process Elfant Wissahickon Philadelphia Realtors

City Of Philadelphia Real Estate Transfer Tax Regulations Pdf Free Download

City Of Philadelphia Real Estate Transfer Tax Regulations Pdf Free Download

Philadelphia Property Tax Bills Are In The Mail Department Of Revenue City Of Philadelphia

City Of Philadelphia Real Estate Transfer Tax Regulations Pdf Free Download

As Philadelphia Hotel And Sales Taxes Evaporate So Do Millions In Funds Philadelphia Business Journal

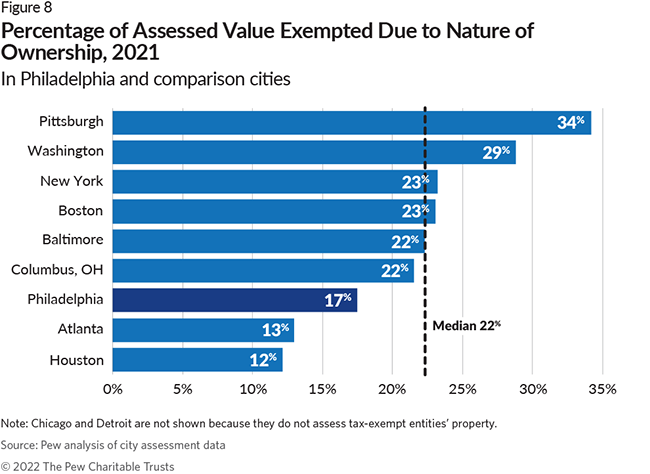

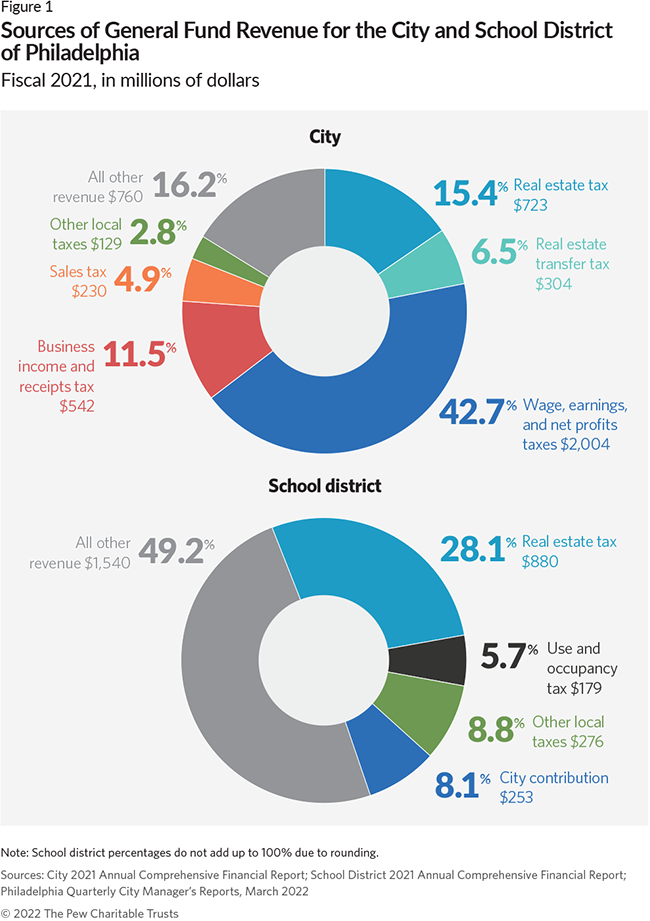

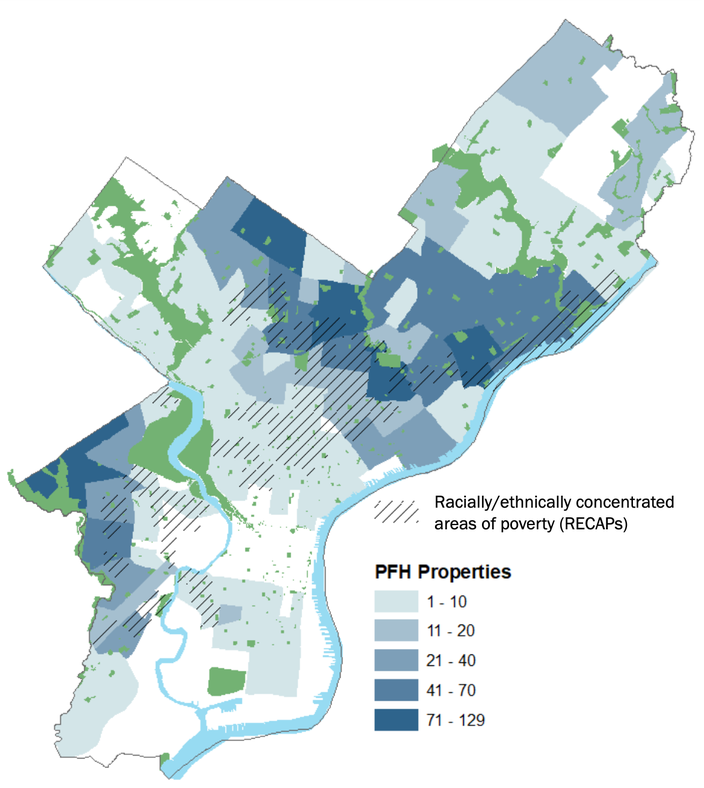

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice

Tax Operations Resume Samples Velvet Jobs

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

From Wage Taxes To Red Tape Here S Why Philadelphia Is One Of The Hardest Cities To Do Business

City Of Philadelphia Real Estate Transfer Tax Regulations Pdf Free Download

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia